Restaurant QuickBooks Guide, 2nd Edition (PDF Format)

Restaurant Accounting is

made easy with this publication.... A 298 page step-by-step guide to the most

popular small business accounting software program. Written exclusively for

restaurant operators, in a jargon free and easy to understand style. The author,

John Nessel, a thirty-six year veteran of the restaurant industry, and

currently a restaurant consultant, is a Certified QuickBooks Advisor, and has

been using QuickBooks since 1994.

Only $79

The Importance of Monthly Restaurant Financial Reporting

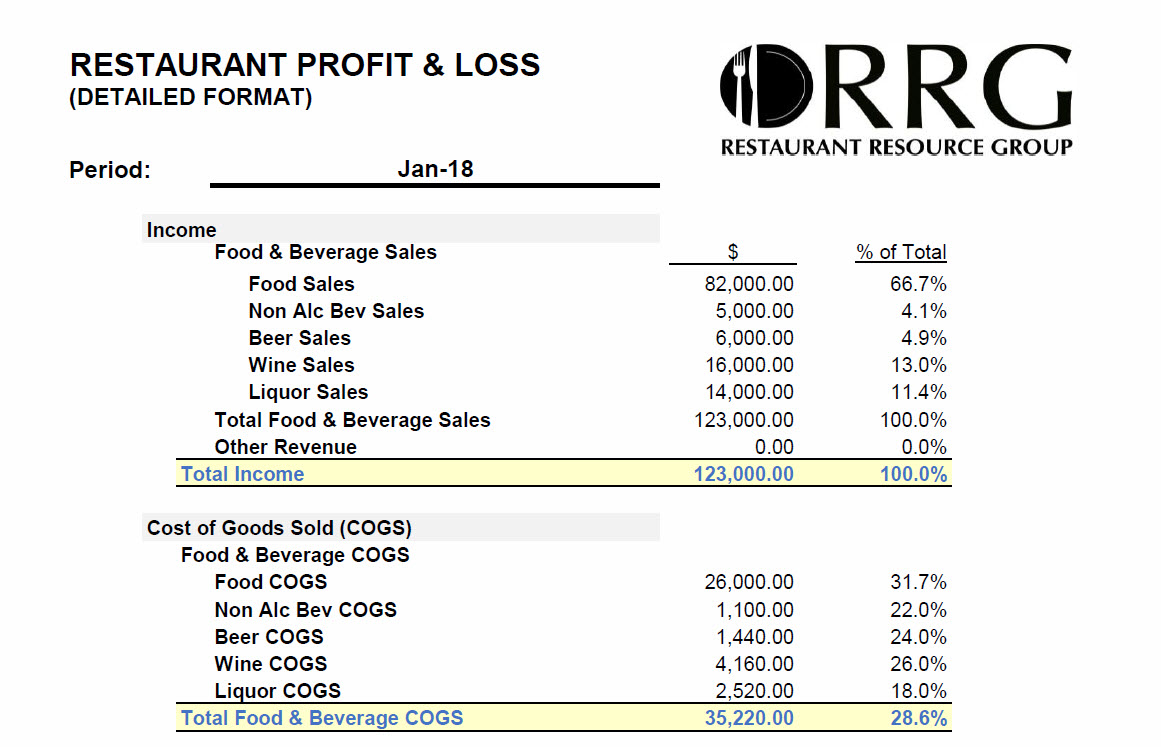

The three critical financial statements that every restaurateur must prepare each month is:

1. the Profit and Loss Statement (P&L)

2. the Balance Sheet; and

3. the Statement of Cash Flows.

The most important of these is the P&L. No business can be run without numbers. Numbers

serve as a thermometer that measures the health and well-being of the

enterprise. Numbers are symbols, very much like words, with their own intrinsic

simple meanings when they stand alone and far more complex and meaningful when

in the context of pertinent other numbers.

There is nothing unique or unusual about the

importance of knowing your numbers. However, the difference between

well-managed companies and not-so-well-managed ones is the degree of attention

they pay to their numbers.

If you do not produce regular monthly financial

reports on your restaurant, you are flying blind. One critical mistake often

made by new restaurant entrepreneurs is that they think they can save a few

dollars by doing their own accounting and get by without the expense of a

professional accounting service.

However, like the saying, The individual who

chooses to act as his or her own lawyer in a court case has a fool for a

client, so is the restaurateur who believes he does not need the services of a

professional hospitality accountant to set up his business books. My personal

experience in working with independent restaurant operators who choose to do

their accounting in-house is that their accounting records and reports are

marginally acceptable to the IRS for income tax purposes and woefully

inadequate as financial management tools for evaluating the financial condition

of their restaurant.

In one case, I worked with a financial

institution when one of their loan customers stopped paying their business

loan. I was asked to look into their situation to see if foreclosure could be

avoided. The couple that built and operated this restaurant had collateralized

their loan with their life savings and retirement funds. The first thing I

asked to see was the financial statements for the last 12 months. When I

reviewed them, I was unable to assess the financial condition of the restaurant

because the statements were prepared using cash accounting instead of accrual

accounting. The local public accountant they used was not familiar with

hospitality accounting and the Uniform System of Accounts for Restaurants.

When I asked the accountant why he was not using

accrual accounting, he replied that there were tax advantages in using cash

accounting. Of course, that was a moot point since the business had never made

a profit. But the biggest travesty of using the cash system was that it had

hidden the fact that their costs were way out of line. In fact, a break-even

analysis showed they were never going to be profitable.

The primary purpose of monthly financial

statements is not to serve as an IRS form to determine your tax liability. The

purpose is to be able to assess the effectiveness of the owner's decisions on

the financial performance of their business. Every decision a restaurateur

makes has financial implications. Adding or deleting a menu item, adding or

eliminating an employee position, changing a menu price, giving an employee a

raise, selecting a new vendor for your supplies, changing the portion size of

an entre and changing your hours of operation all have financial implications.

Your goals should be to increase sales, reduce

costs and increase profit. These are the objectives for any decision you make

for your business. The bottom line is that if you do not know your numbers, you

do not know your business.

The first and most important point about numbers

is that they must be accurate and collected in a timely manner. I was asked by

a successful independent restaurant operator to assess his business and

determine its value. I agreed to do so without any charge and asked him to

provide me with the past 12 months of income statements and balance sheets.

I began to suspect something was awry when he

asked me to guess what his food cost was running and told me to guess. My

response was 27 percent? He said it was 17 percent. No restaurant should run that

low of a food cost because in order to do it, prices would be outrageous, the

portions miniscule and the quality dubious. That was not the case with this

restaurant.

When I looked over his accounting records, which

he did himself with QuickBooks; I saw several glaring flaws in his accounting.

Again, he was using cash accounting instead of accrual accounting, and he did

not separate his beverage sales from his food sales in calculating his food and

beverage cost percentages. When I examined the current assets section of his

balance sheet and did not find an entry for food or beverage inventory, this

told me he was not taking inventory each month and that the numbers he used for

food and beverage cost on his income statement were likely the purchases

(invoice totals) for the month. The reason he came up with a food cost of 17

percent was because he was dividing food purchases by total sales when it

should have been only food sales. In addition, the sales figure he used was

gross sales, which included sales tax.

It seems that there are operators who are

numbers people who enjoy analyzing financials, and then there are those who are

not and are uncomfortable with numbers. Those who are not often defer

collecting and recording numbers to someone else, and do not really understand

what the numbers are telling them. They may not even keep track of customer

counts, sales or the preparing of reports. The latter are numbers that every

restaurant manager, let alone owner, should check every single day.

Another very successful operator asked my advice

because his business had almost been bankrupted by a trusted employee, and he

did not want that to happen again. Again, this operator chose to keep his

accounting in-house and not to use a professional hospitality accounting

service. In addition, he was not comfortable with numbers and deferred to

others who never took a month-end physical inventory and were using monthly

purchases as food cost on the monthly statements. (A physical inventory means

that you will count all food, beverages (alcoholic) and supplies on hand at the

end of the month and extend the value of that inventory.)

The amount that is used for food cost on your

income statement must be cost of food sold, which must be calculated using the

formula Beginning Inventory plus Purchases minus Ending Inventory. That

calculation produces cost of food consumed, and the Uniform System of Accounts

uses cost of food sold, which is cost of food consumed less employee meals,

discounts and complimentary meals, food transfer to the bar and recorded waste.

My first recommendation was to take a monthly

inventory and extend it. Despite my recommendations to get that information,

his operations manager slow-played the process and after three months I

withdrew without ever getting an inventory value. The owner was not a numbers

person and had delegated this important task to his operations manager. I knew

that this was not a good situation and one that should not be permitted. It

preyed on my mind so much that several months later I asked him if he ever got

the inventory completed. They had not. I then told him that as long as he did not

have a month-end inventory, he was vulnerable to the same fraud that had nearly

bankrupted the company earlier.

The detail needed by an operator on their

financial statements is far more detailed that that needed by the IRS to

determine tax liability. I recommend that, at least initially, new restaurants

should retain the services of a professional hospitality accounting firm or consultant to set

up their QuickBooks file and procedures. The cost of this service is about 1 percent of

your sales, and that is the best money you will ever spend.

The restaurant accounting professional will show you how to record

your daily sales and deposits, payments for supplies and payroll, and they can prepare your sales tax and

payroll tax forms each quarter. Your in-house bookkeeper can assemble the data

for your accountant and use QuickBooks to do that if you wish. If, after a

year you believe that cost for such services and peace of mind is too much and

you are a numbers person, you can consider doing everything in-house because

you will have a template for what you need to do. One caveat is that in-house

accounting is NOT the way to go if you are NOT a numbers person and the

recommendation to do away with the outside accountant is adamantly supported by

your in-house bookkeeper. You need to have a system of checks-and-balances when

it comes to your financial records.

When you have mastered the numbers, you will no

longer be reading them any more than you read words when reading a book. You

will be reading meanings. Your eyes may be seeing numbers, but your mind will

be reading food cost, market share, gross profits, prime costs, etc. All the

things you are doing and planning will jump out at you, if you will only learn

to read through the numbers.

Dr. David Pavesic is a

former restaurateur and retired professor at the Cecil B. Day School of Hospitality

at Georgia State University.